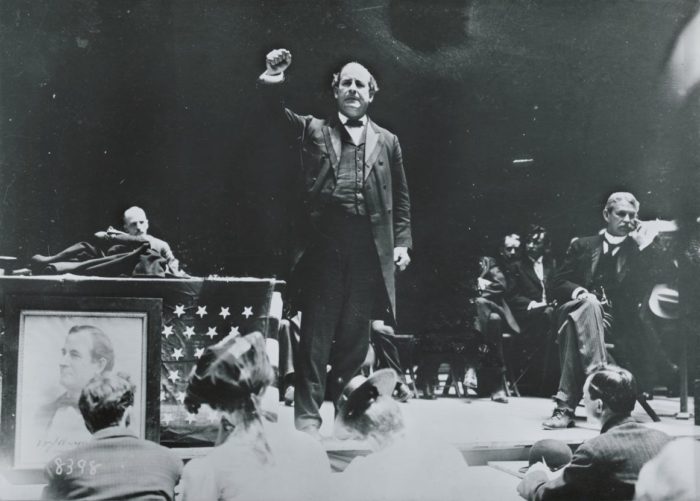

!["You shall not press down upon the brow of labor this crown of thorns; you shall not crucify mankind upon a cross of gold." - Wiliam Jennings Bryan Cross of Gold Speech, 1896 [wikimedia.org]](https://i0.wp.com/blog.tomiwa.ca/wp-content/uploads/2016/11/William_Jennings_Bryan_cross-of-gold.jpg?resize=700%2C501)

Two very good books which I recommend to provide an understanding of this topic are Money: Whence it Came, Where it Went by John Kenneth Galbraith 5 and The Death of Money by James Rickards.

Following financial news you often hear the phrase, “This time it’s different”. However, that slightly changed when I found out that interest rates over the last 5 years have averaged 2.14% and in the last 500 years interest rates have only ever been this low twice, the 1570s and 1930s 6 (5-year average from 1939-43 was 2.29%). My reaction actually wasn’t “wow, this time it really is different”, my reaction is, “wow, this seems like history repeating itself”, which is actually even more concerning. This is a classic case of recency bias as the last time a major currency collapsed was WWII Germany and the last time the US currency experienced serious deflation was during the US civil war. Most people in developed countries have never experienced unstable money, so the idea that their currency is under threat is difficult for many people to understand.

![Customers queue to take money out of an American bank, 1928.[fortressgoldgroup.com]](https://i0.wp.com/blog.tomiwa.ca/wp-content/uploads/2016/11/america-bank-run.jpg?resize=650%2C463)

![Customers queue to take money out of a Greek bank, 2015.[kingworldnews.com]](https://i0.wp.com/blog.tomiwa.ca/wp-content/uploads/2016/11/greece-bank-run.jpg?resize=730%2C406)

This all sounds very doomsday-ish and conspiracy theory-ish but if you take a long-term view of history, this is actually what is supposed to happen with a fiat monetary system. When money is not backed by any commodity to put constraints on spending, politicians lack the fortitude to resist the temptation of printing money to solve short-term problems, at the expense of long-term stable money. The only support the money has is the public’s, often naive confidence in the money that they hold. The fundamental problem is that it becomes a speculative waiting game of trying to comprehend what will trigger the collapse. Nero, Napoleon, and Lincoln all debased their currencies to finance wars and the US government did the same to finance wall street 7.

To be fair, one could make a strong argument that there are times when the Keynesian school of economics and government stimulation of monetary policy can be useful. For example, China’s devaluation of the Renminbi has helped its export markets. Abraham Lincoln financed the civil war that helped to abolish slavery through the printing of US legal tender notes, “greenbacks”. Franklin Delano Roosevelt’s “New Deal” programs help take America out of The Great Depression and was partly made possible by an increase in the money supply. 8 However, we should keep in mind that these solutions typically work best in the short term to provide an adrenaline shot to the economy. In the long term, continued periods of easy monetary policy will ultimately lead to high inflation that negates government stimulus and leaves the average citizen poorer in real terms. Following the boom of the 1940’s to 70’s was high unemployment (peak of 10.8%) and inflation (peak of 13.5%) in the early 80’s. So we can see that there’s a time and place for government stimulus; but can we, in the words of William McChesney Martin, be trusted “to take away the punch bowl just as the party gets going”.

Governments have tried to intervene in the free markets for too long because of the political effects of a recession in the economy. However, some pain is necessary in any properly functioning economic cycle, especially following periods of irrational exuberance. Ray Dalio’s essay, Principles is a very useful reference for this topic. The only questions remaining are when will this correction happen and how can one position themselves accordingly. The timing question is arguably harder to answer than the meaning of life, so we only concern ourselves with the latter and just try to prepare accordingly.

Customers queue to take money out of an American bank, 1928.[fortressgoldgroup.com]

The question of deflation vs. inflation is another issue that is currently being debated by various smart people. The issues raised become very abstract and technical but the key implication is that people who are not adequately hedged and have most of their savings in cash and securities may be in for a rough period. So we need to introspectively ask, “What can we do to prepare ourselves?” In addition to the aforementioned texts, another useful book for understanding how to survive in an environment where the money system is essentially non-functioning is an obscure 1931 Italian book called The Economics of Inflation by Constantino Bresciani Turroni which uses the depreciation of the German Mark from 1914 to 1923 as a frame of reference.

Precious Metals have stood the test of time, and have outlasted every single man-made currency system. Tangible assets like land and agricultural commodities will also be useful in a confused economic climate. As an occasional reader of alternative new sources, I am very wary of conspiracy theorists and eccentrics but I think the rational thing to do is position ourselves from the perspective of; If I am wrong, It won’t make much of a difference; but if I am right, I might be able to minimize my level of suffering. This is a useful outlook on life that allows us to make the best of whatever challenges and opportunities life presents to us.

Notes:

- Galbraith has quickly become my favorite economist with an ability to compile vast pieces of information and draw useful conclusions without projecting too much of his own biases on the facts, a very rare feat in economics. ↩

- http://www.econ.yale.edu/~shiller/data/Fig3-1.xls ↩

- I have always found it interesting that a US central bank governor was an advocate for the gold standard, see Alan Greenspan, Gold and Economic Freedom (1966) ↩

- The Gold Reserve Act of 1934, increased the price of gold and allowed the US central banks to increase the money supply. ↩

- Galbraith has quickly become my favorite economist with an ability to compile vast pieces of information and draw useful conclusions without projecting too much of his own biases on the facts, a very rare feat in economics. ↩

- http://www.econ.yale.edu/~shiller/data/Fig3-1.xls ↩

- I have always found it interesting that a US central bank governor was an advocate for the gold standard, see Alan Greenspan, Gold and Economic Freedom (1966) ↩

- The Gold Reserve Act of 1934, increased the price of gold and allowed the US central banks to increase the money supply. ↩